One of many various rules, the new FHA’s “100-Mile Laws” commonly shines due to the fact such as for instance problematic for individuals. Unfamiliar to many homebuyers, there have been two 100-kilometer regulations, for every having its very own effects and requires.

Inside blog site, we shall explore these two regions of brand new 100-Distance Code, working out for you know the way they might perception the FHA mortgage feel.

Table from Material

- 100-Distance Rule getting one minute FHA Financing

- 100-Kilometer Code For rental Earnings

- Simple tips to Be eligible for an FHA Mortgage

- Choice Fund to possess Homeowners Affected by the fresh 100-Mile Code

- Faqs (FAQs) Regarding the FHA Fund in addition to 100-Kilometer Laws

- The bottom line

100-Mile Laws so you can get another FHA Mortgage

The main standard let me reveal distance: if you find yourself moving in having a position and your new house are over 100 faraway from your own newest household, you can even be considered to hang a separate FHA loan.

click site not, navigating this part of the signal isn’t simple. It will take good-sized proof, like papers of the relocation causes, the length between your dated and you may the latest homes, and your agreements to your basic possessions.

100-Distance Rule For rent Earnings

Right here, the new FHA stipulates that when you’re swinging and you will browsing lease your latest household, the newest leasing income can only just qualify in your the fresh new loan certification if for example the new home is over 100 a long way away.

This code was created to end individuals from using FHA financing to locate multiple attributes for rent objectives without having high security in them.

This may angle a serious difficulty when you’re transferring lower than 100 a long way away and are usually according to the leasing income out of your earlier the home of qualify for another loan.

The brand new restriction aims to retain the stability off FHA loans, making sure they truly are made use of mainly private houses as opposed to strengthening an effective a residential property portfolio.

One another aspects of the new 100-Distance Signal are intended to stop this new abuse from FHA finance. They make certain these loans serve its priilies purchase their number one homes.

However, to possess individuals that lawfully transferring and require to deal with multiple features, these laws can truly add levels from complexity into the mortgage processes.

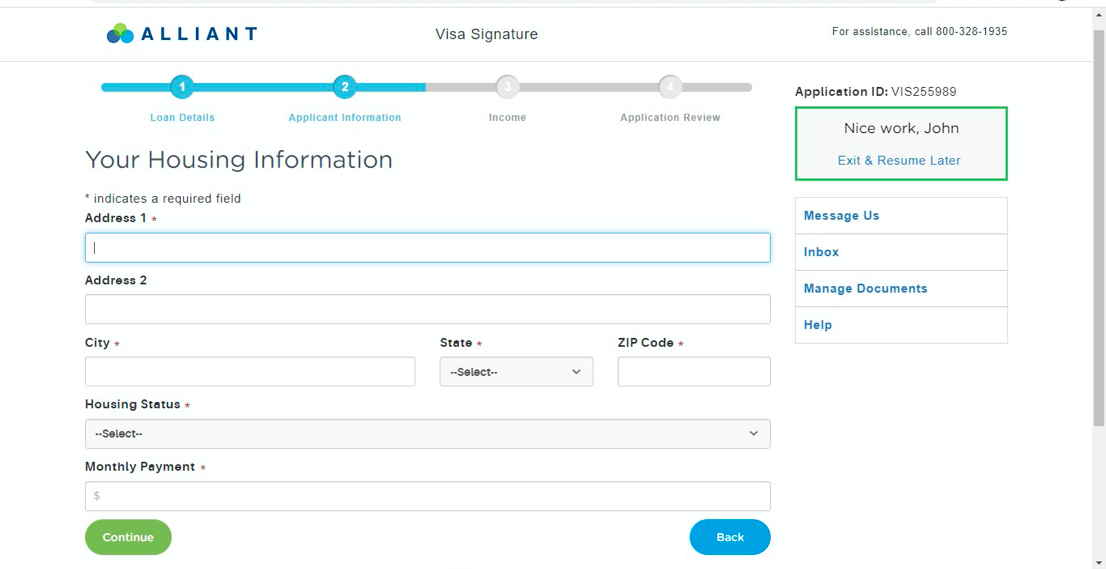

Just how to Be eligible for a keen FHA Mortgage

In terms of protecting a keen FHA financing, there are some tips to take on. Expertise these may help you determine qualification and you will prepare for the fresh new software processes.

Credit history and you will Deposit

Generally, consumers you desire at least credit rating off 580 in order to be eligible for the new FHA’s low-down fee advantage, that is currently on 3.5%.

Should your credit score are ranging from five hundred and you may 579, you might still qualify, however, a larger % downpayment from 10% may be required.

Debt-to-Money Proportion (DTI)

FHA assistance generally want an excellent DTI proportion away from 43% or reduced, however, there was days in which consumers having high DTI percentages is become recognized, especially with compensating products.

Financial Insurance coverage

With an enthusiastic FHA mortgage, you ought to pay money for home loan insurance rates. This consists of an initial financial insurance premium (UFMIP) and you will an annual superior split into monthly installments. Which insurance coverage covers the lending company in the event of borrower standard.

A job History and you can Money Stability

FHA fund wanted individuals having a steady a job record and you will money. Loan providers typically come across a two-seasons works records, though present graduates otherwise those with a valid reason for employment openings can still be eligible.

Property Conditions

The home you want to pick which have an enthusiastic FHA loan need see particular protection, shelter, and architectural integrity conditions. An FHA-acknowledged appraiser must see the property to make certain they match this type of requirements.

Option Funds having Homeowners Influenced by new 100-Distance Code

This new FHA’s 100-Mile Laws can be expose a critical difficulty for some potential homebuyers. But not, it is critical to just remember that , that isn’t the conclusion the newest street. You can find solution loan available options that may help you achieve your domestic-purchasing needs.