Residents who have depending a few years’ equity within their homes can utilize this beneficial asset by the putting it to the office. Do you realize you could refinance and employ the situated-up equity to pay off user expense particularly credit cards, non-mortgages, or other expense? The simple truth is!

Debt consolidation https://paydayloanalabama.com/spruce-pine/ reduction refinancing was a popular choice for some people-and that’s as it simplifies costs investing, decrease the amount of money supposed into the financial obligation provider for each week, and you may allows way more financial independence.

Residents may ponder, Is actually property refinance so you’re able to combine obligations ideal selection for me personally? If you are considering refinancing, the experts was right here in order to see the the inner workings out of a debt consolidation loan to make the choice which is most effective for you.

Reduce your Price

Refinancing so you’re able to a diminished interest rate can lead to high long-label savings and relieve your month-to-month mortgage repayments. By securing a better speed, you’ll save money across the longevity of your loan, freeing up funds with other financial goals otherwise expenditures.

Pay Personal debt

Because of the making use of your house’s security, you could repay a fantastic costs and enjoy one, lower-appeal payment, simplifying your money and cutting complete desire can cost you.

Straight down Mortgage payment

Lower your monthly mortgage repayment which have a simple re-finance. Of the adjusting the loan terminology otherwise securing a lowered interest rate, you can save several thousand dollars a year, and then make the mortgage inexpensive and reducing debt weight.

What exactly is a debt settlement Refinance?

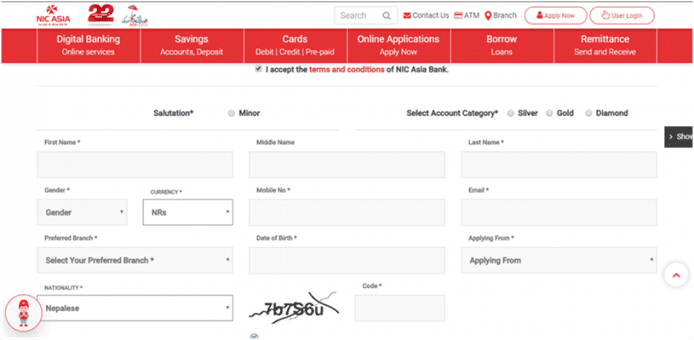

Debt consolidation reduction fund (a.k.a great. cash-aside refinance) is actually financing that change your established home loan having a brand-brand new home mortgage for over your balance on your own house-and also the variation is reduced for your requirements into the bucks. Quite simply, you can buy bucks and get a special financial at same time, while also consolidating your financial situation.

During debt consolidation reduction fund, residents eliminate off their situated-in home guarantee and you will consolidate other large-notice bills by the running them towards a brandname-the fresh new home loan. It indicates your own credit card stability or any other loans get bundled towards this new mortgage matter-starting a single payment per month for all your costs. From inside the closure of a debt negotiation refinance, your credit cards and low-mortgage loans receives a commission of. It contributes to a top mortgage harmony, additionally the low-financial bills rating immersed towards the brand new financing.

When Is Debt consolidation A good option?

Debt consolidation is recommended to have residents that have a whole lot out of equity inside their belongings which are stolen to expend out of most other highest-attention debts (particularly handmade cards, auto loans, or personal loans). As the objective is always to refinance towards the the lowest-appeal home loan, individuals with a high credit score can be found in an educated condition to take advantage of it refinance sort of.

In addition to credit ratings, loan providers have a tendency to check property owners considering their earnings and you may loans-to-money ratios. Individuals must be at the very least 18 years old, court U.S. citizens with good verifiable family savings, rather than enter case of bankruptcy or foreclosure.

How come a consolidation Refinance?

Now that you recognize how these financing performs, you are probably thinking: so is this the proper loan for me? There are about three important inquiries people is always to inquire themselves regarding a debt settlement re-finance:

Am i going to down my rates?

The primary reason home owners will prefer a debt consolidation mortgage is always to change from having high-appeal, personal debt to presenting lowest-focus, shielded personal debt. Instance, bank card rates of interest normally range from 10% so you’re able to twenty-five%, based on the dominating amount owed. Mortgage loans, although not, has competitively lower rates, hanging as much as 2% so you can 5%. Very, selecting the right debt consolidating mortgage is largely influenced by and that financing offers the lowest apr.