- Review the credit history to have errors: Youre named by federal rules to acquire a totally free duplicate of your own statement out-of all the three big credit rating bureaus thru AnnualCreditReport. We advice closely examining all the around three of the credit reports so you can find out if there can be erroneous suggestions that will be injuring your ratings, instance a late commission you made punctually or an excellent past-owed membership that you never unwrapped. Attempt to accomplish that very early so that you have time to conflict and you can best problems before you apply getting home financing. Otherwise, with discover disputes might complicate the loan recognition.

- Create all of your money promptly: Your fee history is one of the most very important rating affairs, and you may and make on the-time repayments can help your own borrowing. In the event a merchant account does not report their into-date repayments towards the credit reporting agencies, you won’t want to get behind and have the account delivered so you’re able to collections for the reason that it you are going to nonetheless hurt their credit scores.

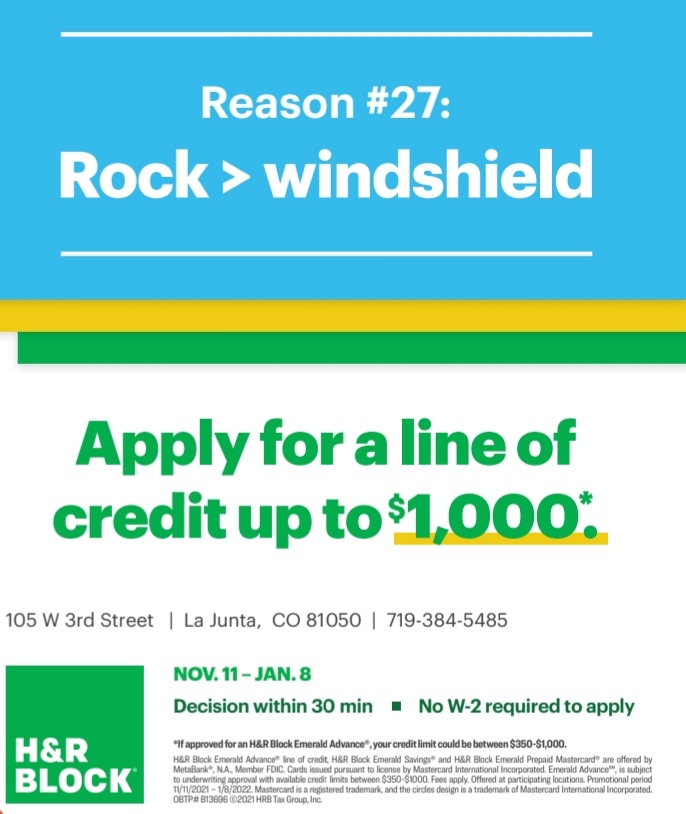

- Cannot apply for the brand new borrowing: Starting the latest borrowing from the bank levels is going to be essential for capital purchases and you will building credit eventually. Nevertheless basically would not want taking out financing otherwise opening playing cards right before trying to get a home loan due to the fact app and you will the account could damage your fico scores.

- Reduce bank card balance: Their borrowing card’s advertised harmony according to the credit limit-its borrowing from the bank usage ratio-is a significant rating grounds. If you find yourself carrying balances, just be sure to pay them off as quickly as possible to increase their fico scores. Even though you pay the statement completely every month, paying the bill till the prevent of every report period can result regarding the issuer reporting less equilibrium, which results in a lower life expectancy usage rates.

- Keep utilization price over 0%: Though large borrowing application pricing are usually even worse for your borrowing ratings, with an excellent application price from the reduced unmarried digits could actually be much better than just 0%. You can do this if you are paying along the balance through to the declaration day and then investing it off after the declaration closes and until the bill is born. Cannot revolve charge card balances every month if you can be able to spend the money for statement completely-there isn’t any extra benefit to the borrowing to accomplish this and you may you can easily basically bear expensive appeal costs.

The latest takeaway

It could be possible to locate recognized to have a mortgage that have a rating as low as five-hundred, but that is with specific caveats-you are making an application for an enthusiastic FHA home loan and that you tends to make at the very least a beneficial ten% advance payment, to mention two big ones.

If you don’t already have advanced level credit, working to alter your borrowing from the bank you will definitely enhance your chances of getting approved and you may-possibly researching a lesser interest than you or even create

Know that mortgage brokers commonly play with specific credit rating models when examining software. Nonetheless they may have different minimum credit rating requirements considering the type of financing, your overall creditworthiness, as well as the information on the acquisition. If you wish to look at the ratings a lending company is actually gonna rely on, your best bet could be to acquire a registration due to myFICO. During that installment loans online in Nevada it composing, they runs $ per month.

The financing results you should check for free essentially are not the fresh new of these that mortgage brokers fool around with, but can still be helpful in providing a sense where you happen to be at. And many rating business deliver wisdom into the what is permitting or injuring your own score.

Loan providers commonly briefly supply the Classic Credit scores and the latest score whenever this type of alter initiate. After that, from the 4th quarter off 2025, the new Classic Results might possibly be eliminated. There clearly was however certain lingering talks in the info, however, mortgage brokers together with may have a choice of having fun with guidance and you will results off two credit file rather than around three.