- Financial underwriters test your app and you may data so you can approve otherwise decline your application

- Computers is also agree mortgage loans, but human underwriters must verify that your write-ups satisfy the suggestions on your own application

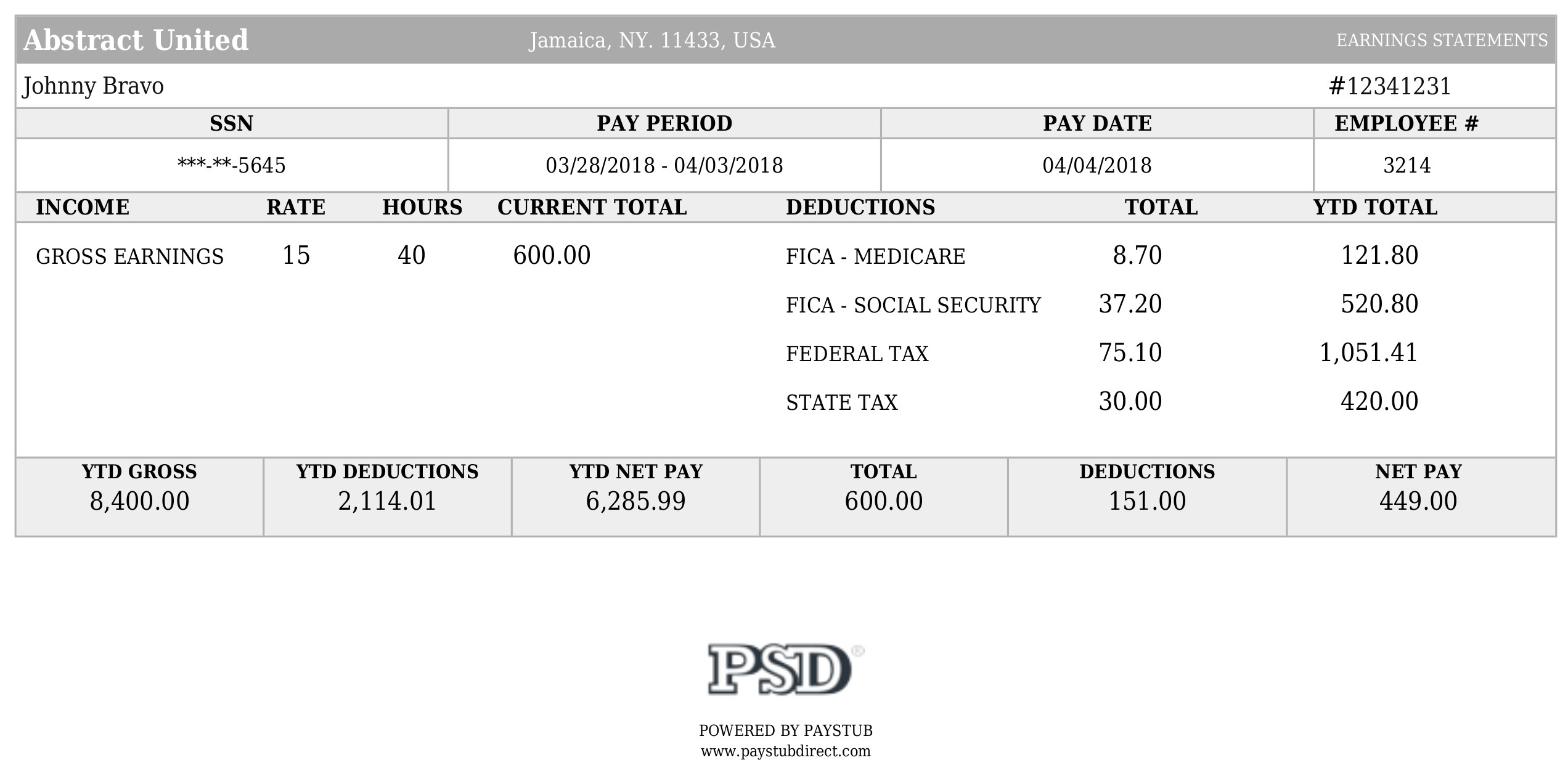

- Underwriters usually require proof your income and you will property and might features a lot more requests

Their recognition is commonly at the mercy of criteria. Such conditions can range of lender statements in order to tax returns in order to reasons regarding your borrowing. All of the conditions need to be into the and you may accepted before you could romantic.

They begins with a loan application

You start the application processes of the handling that loan manager otherwise financing chip. They requires your details and you can completes an interest rate app.

The loan manager studies the loan Imagine (LE) function or any other disclosures along with you, answers your questions in regards to the forms, and you can tells you all you have to make available to safer your own mortgage approval.

Underwriters have a look at an excellent borrower’s about three Cs. That is reputation, guarantee and you can strength. Put simply, your credit score, earnings therefore the property value.

Underwriters commonly constantly individual

In most cases, the loan manager otherwise processor submits the application electronically to help you an automatic underwriting program (AUS). The program generates a referral and a listing of conditions, which you must fulfill to help you completed their approval. (Fannie Mae’s Desktop Underwriting bodies efficiency include accept, recommend, otherwise refer which have alerting.)

If you get a good refer impulse, a human underwriter must take one minute lookup and perhaps underwrite your loan yourself. Send which have alerting means the machine refuted the job.

If you get a keen approve response, the system kicks away a listing of criteria you must see to finish their acceptance. The loan manager will assist you to rating these materials, and a person underwriter will make sure that data files you promote satisfy the information about the loan software.

Financial underwriter list

An initial part of underwriter is always to approve finance one will do and you can restriction chance. That means cautiously investigating an effective borrower’s whole loan profile. Typical tasks were

Examining credit history. Your credit report the most important factors when you look at the the loan recognition techniques. Underwriters become familiar with your credit history because of the way you addressed obligations previously is a good predictor away from the way you have a tendency to deal with the mortgage responsibility. Later payments or collections will demand most documentation.

Verifying employment and you may income. Underwriters guarantee the a position records to make sure your earnings is secure. They may phone call your employer to make sure you functions around and certainly will comment the last one or two years’ W-2s otherwise tax statements. Underwriting solutions along with examine your earnings and you may bills, calculating what is actually called a personal debt-to-money proportion, otherwise DTI.

Look at domestic appraisal. An authorized family appraiser compares the house so you can regional, equivalent homes, and you may set its ine the brand new assessment to ensure the newest appraiser observed the lender’s direction making accurate customizations to access the significance given to your home.

Guarantee asset advice. Their downpayment was the one thing and you can underwriters examine they carefully. Made it happen are from the financing? Otherwise does the history savings account report contain certain weirdly huge deposit? They will certainly quiz you and require more data, therefore, to make sure that the fresh deposit was not lent otherwise supplied by somebody who benefits from the new purchases, like the provider or agent.

Automated underwriting

Really banking companies and you may lenders explore Automatic Underwriting Options (AUS). He or she is higher level app expertise that bring preliminary underwriting choices.

The device allows the human being underwriter know if home financing applicant meets the new lender’s advice, centered on recommendations about application for the loan and you can credit file.

Immediately following a loan administrator otherwise processor chip submits an application, the latest AUS reports its findings and you can yields standards. Usually, criteria just cover showing one what was type in into the software is valid – bank comments and you may pay stubs, for instance, to ensure the funds and you will property said to your application.

Extremely lenders do some manual underwriting out of mortgage programs. Constantly, this is because the applicant possess an inadequate credit rating and/or credit history could have been compromised by the id theft. Unusual mortgages otherwise very large financing are also appear to underwritten by hand.

Approved with criteria

There are certain steps in delivering a mortgage loan. Your first step is actually mortgage pre-qualification. And possible done a loan application and you will fill in they to own home loan pre-acceptance. Immediately following your loan happens out-of underwriting, the aim is to have your loan recognized having conditions.

You shouldn’t be scared should your bank lets you know the approval enjoys conditions. A beneficial conditional loan small personal loans Denver acceptance is quite practical. Rewarding the borrowed funds criteria, what they could be, is how your change their conditional financing approval for the the full/latest acceptance.

Underwriting requirements can differ according to sort of mortgage to possess and therefore you have used, the a career, income and you will full borrowing from the bank reputation. The method that you otherwise the bank finish the mortgage software is determine your own recognition in addition to requirements you need to meet.

Last recognition

Examples of underwriting standards can sometimes include from documentation of correct homeowners insurance so you can characters out-of factor definitely items in question with your financing document.

And lots of conditions is lead to a request for extra ones. For-instance, your pay stub consists of a beneficial deduction to have youngster help you didn’t put-on the job. Now you will have to bring your split up decree.

A good thing you can do as a quickly-to-getting homeowner is to try to react punctually toward financing officer’s demands. You need to learn not to take brand new messenger right here.

Your loan officer is your liaison ranging from you and this new underwriter. If not understand or can’t conform to a condition, she or he might possibly support you in finding a beneficial way around they and just have your loan signed. Remember that the lender employees are ultimately on your side and you can undertaking their very best to help you intimate the loan timely.