FHA Loan

FHA money offer an advantage more than antique funds since they are backed by the fresh FHA and/or Federal Construction Government, which is the planet’s prominent mortgage insurance carrier. The latest FHA will not lend currency, as an alternative they straight back lenders if the borrower’s default to your mortgage.

- Try very first time homebuyers

- Features mediocre, poor otherwise restricted borrowing

- You want loans Cos Cob a smaller downpayment option

- Need to consider extended co-borrower choice

Connection Loan

These types of money are generally for individuals who was swinging from a single where you can find one other and wish to utilize the security for the its existing house, to put a downpayment to their new home. This type of mortgage will act as a change automobile anywhere between a few services and you will lets individuals to access collateral in their newest domestic to make use of while the deposit because of their next pick. I allow borrowers in order to mortgage doing 80% of one’s appraised property value the current domestic.

- Offer your existing family and buying another type of house otherwise are preparing to have your home built

- Desire the genuine convenience of a smooth loan in the offering process of one’s latest family

USDA Financing

An excellent USDA financing or even also known as the fresh Outlying Casing Mortgage has a 30-12 months term with an interest speed set because of the financial. There is no minimal downpayment and you will enables 100% capital. It will keeps income and you will credit criteria to meet the requirements and certainly will Only be used for number one home.

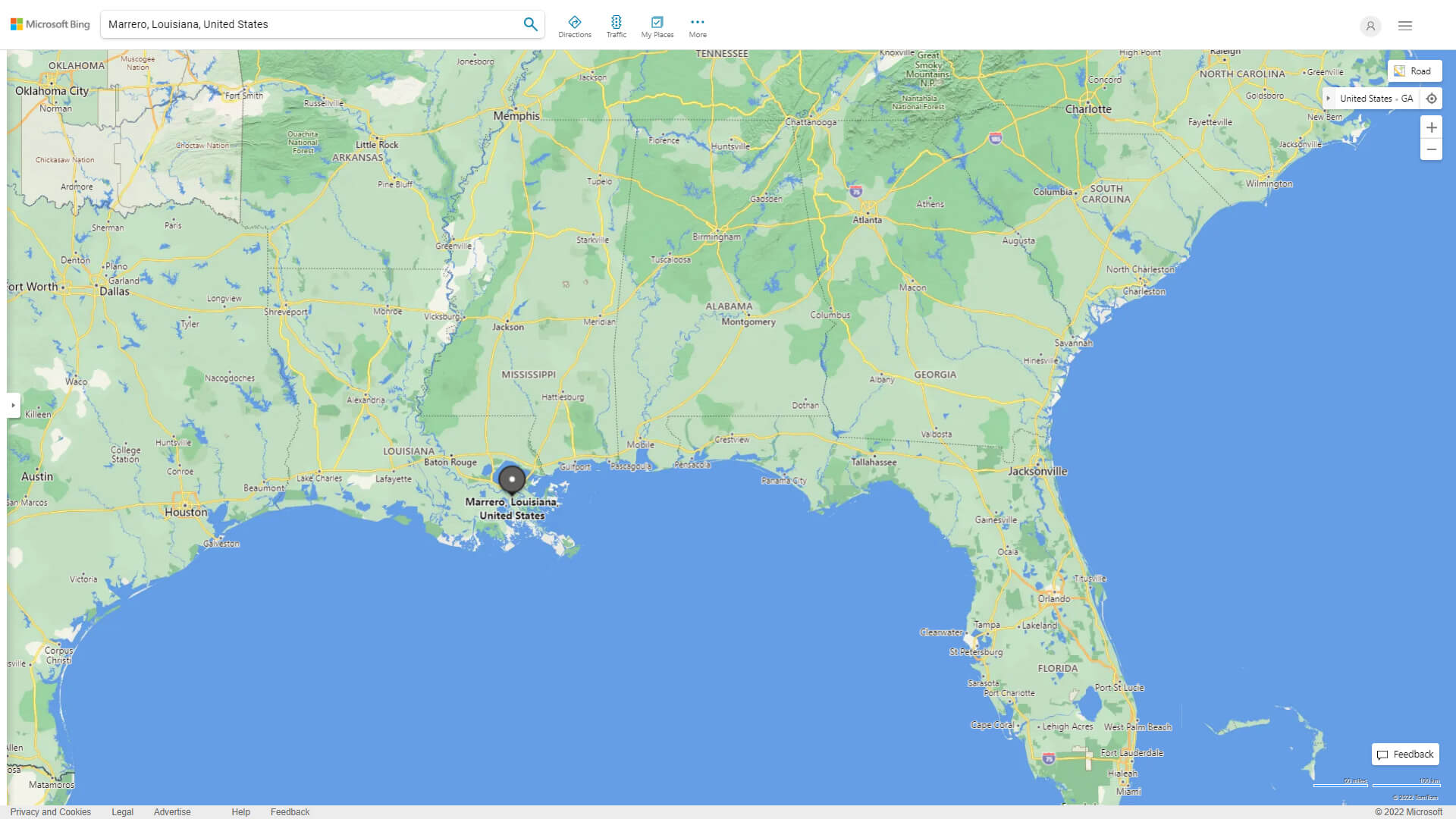

- Are now living in a rural city

- Keeps a good credit score and you will verifiable money

- Plan on remaining in your house 5+ decades

Parcel & Home Fund

These two style of money is actually having possibly small- or much time-label funding. Much financing was quick-name funding always get an improved package who has preventing and/otherwise utilities in position, on purpose to build a different sort of domestic or cabin towards the they within a year. An area Financing is actually long term, generally speaking used to pick raw land and does not need to be made better home with resources set up. An area financing is usually used for some one wanting property to fool around with for recreation otherwise future generate. These loans could possibly get match your economic requires wise to:

Lake Area Home loan also offers an array of mortgage loans, to suit any household customer. Remember, our very own down payment guidelines plans arrive to your several of our very own mortgages; definitely find out about the choices

E mail us toll-free from the 1-866-321-1566 to talk to a pond Town Home loan company or visit the site on Lake City Mortgage today! All of us work with you to aid determine which mortgage sorts of is the best for your!

***Mortgages try originated by the Lake Town Home loan, and so are subject to borrowing recognition, confirmation, and you may guarantee comparison. Programs, also offers, cost, conditions, and criteria is actually susceptible to alter otherwise termination without notice. Particular conditions pertain. ***

It declaration address sensible homes from inside the rural areas regarding United States therefore the higher Midwest, having a certain emphasis on criteria within the Minnesota. Within perspective, we offer detailed information about the latest inventory regarding multifamily housing that is part of the usa Company out-of Farming (USDA) Part 515 construction system and you can measure the measure and range from constant concerns regarding the continuing future of this method. Since features on Part 515 program mature out of the system within the next ten so you’re able to 3 decades, Minnesota really stands to shed a hefty proportion out-of local rental houses already used by reasonable-income home in the nonmetropolitan aspects of the state. With no obvious backup plan for keeping affordability within these attributes, many attributes as the terms of the affordability limitations expire. This may suggest the newest displacement of a lot tenants residing in 515 characteristics that have confidence in new housing subsidies that accompany they.