“Cryptography market volatility: Understand the relationship between the price of cryptocurrency and economic growth”

The world of cryptocurrency has been plagued by volatility in recent years, and prices often fluctuate enormously between ups and downs. A key factor that contributes to this volatility is the concept of Risk-Risk Relationship (RRR), which measures the potential performance of an investor against its potential loss.

Risk-Reompensa ratio (RRR)

The RRR is calculated by dividing the gain or loss of price of a cryptocurrency for its current price. A high RRR indicates that an investor can gain significant yields, while a RRR under suggests that losses can exceed profits. For example, if a cryptocurrency has a 10% gain and a loss of 20%, the RRR would be 0.5, indicating a relatively balanced risk reward ratio.

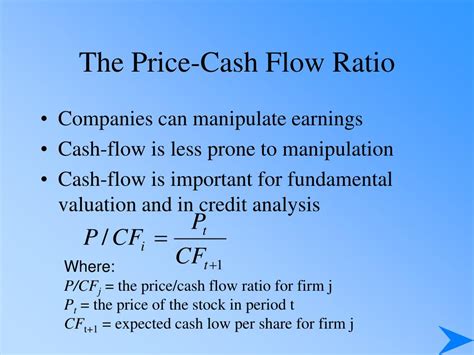

Fundamental valuation

The fundamental assessment is the study of the intrinsic value of a company based on its financial statements, management equipment, industry trends and other factors. When it comes to cryptocurrencies, the fundamental assessment is often compared with traditional actions through metrics such as profit price relations (P/E), dividends yields and business value to EBITDA (EV/EBITDA).

Price/profits ratio (ratio p/e)

The P/E ratio is a widely used metric to value companies. In the context of cryptocurrencies, it is essential to consider that the underlying business model can significantly differ from traditional industries. For example, mining and transactions processing activities of Bitcoin generate income through block rewards, transaction and energy consumption rates.

A high relationship P/E may indicate that investors are willing to pay a premium for upward potential, while a low relationship could suggest that investors expect significant losses in the future.

Dividend yield

Dividend yield is another important metric to consider when evaluating the fundamental valuation of a cryptocurrency. It represents the annual payment of dividends per share divided by the price of the shares. High dividend yield can indicate a relatively stable income flow, while a low dividend yield can suggest that investors expect a significant decrease in future prices.

Gas (Energy Consumption)

The energy consumption of cryptocurrencies has caught attention in recent years due to concerns about the environmental impact of block rewards and transaction processing. The amount of “gas” used by a cryptocurrency is usually measured in “megawatt-hora” units (MWh) per second.

For example, the Bitcoin network consumes approximately 70 energy TWH annually, while the Ethereum network uses about 20-30 TWH per year. This translates into important greenhouse gas emissions and can generate concerns about the sustainability of cryptocurrency mining operations.

Real world applications

Understanding the relationship between the price of cryptocurrencies and the fundamental assessment is essential to make informed investment decisions. When analyzing the proportions of risk reward, dividend yields and energy consumption, investors can better evaluate the rising potential and the inconvenience of the different cryptocurrencies.

For example:

- The high RR (1.5) of Bitcoin can make it attractive to investors seeking significant yields.

- The relatively low P/E ratio of Ethereum (24) could suggest that investors expect less volatility of prices in the future.

- High dividend yield (100%) of some Bitcoin centered indicates a stable income flow, potentially attractive to investors looking for regular income.

Conclusion

Cryptocurrency prices are inherently volatile, and understanding relationships between risk-reompensses relationships, fundamental valuation metrics and energy consumption can provide valuable information for investors. When considering these factors, people can make more informed decisions when evaluating cryptocurrencies and their possible yields.