“Crypto Market Trends: A Deep Dive into Mempool, ICOs and RSI”

The cryptocurrency market has been on a wild ride in recent years, with prices fluctuating wildly between highs and lows. One of the key drivers behind this trend is the increasing adoption of digital currencies by mainstream institutions and individual investors alike. To gain a deeper understanding of these trends, let’s take a closer look at three crucial aspects: Mempool, ICOs, and RSI (Relative Strength Index).

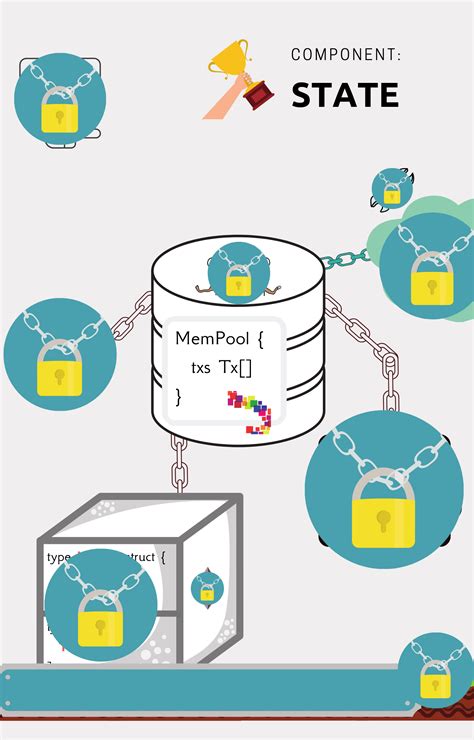

Mempool: A New Era in Digital Currencies

Mempool is an open-source platform that enables developers to create and deploy decentralized applications on various blockchain networks. By providing a scalable, secure, and user-friendly infrastructure for building dApps, Mempool has become a crucial component of the growing digital currency ecosystem.

Developers can use Mempool’s APIs to build, test, and deploy their own applications, without worrying about the underlying network or regulatory requirements. This makes it an attractive option for developers looking to create innovative products and services that leverage blockchain technology.

Mempool’s platform has attracted significant attention in recent months, with notable projects such as Compound and Aave leveraging the platform to build decentralized lending and trading protocols. As the adoption of Mempool continues to grow, we can expect to see even more exciting innovations emerge from this platform.

ICOs: The Next Wave of Blockchain Adoption

Initial Coin Offerings (ICOs) have long been a staple of the cryptocurrency market, providing a way for new projects to raise funds and connect with potential investors. However, in recent years, ICOs have become increasingly sophisticated, with many projects incorporating innovative features such as white-label wallets, liquidity pools, and governance systems.

One of the key benefits of ICOs is their ability to provide a platform for decentralized fundraising, allowing developers to build projects without the need for traditional venture capital firms. This has democratized access to funding for innovative projects, enabling them to reach a wider audience and gain traction in the market.

However, with great power comes great responsibility, and ICOs have also attracted significant scrutiny in recent months. Regulatory bodies around the world are grappling with the implications of ICOs on their regulatory frameworks, highlighting the need for greater clarity and oversight.

RSI: A Powerful Indicators Tool

The Relative Strength Index (RSI) is a popular technical indicators tool used by traders to gauge market momentum and identify potential trends. Developed by J. Welles Wilder in the 1970s, RSI measures the speed of price changes relative to the speed of price changes over a given period.

By plotting the difference between the high and low prices of an asset against its range over time, RSI provides a simple yet effective way to identify potential buying or selling opportunities. The RSI typically ranges from 0 to 100, with higher values indicating overbought conditions and lower values indicating oversold conditions.

The RSI has become a staple in many traders’ toolboxes, serving as a valuable complement to more traditional indicators such as the Moving Averages and Bollinger Bands. By combining technical analysis with fundamental research, traders can gain a deeper understanding of market trends and make more informed investment decisions.

In conclusion, Mempool, ICOs, and RSI offer unique insights into the dynamics of the crypto market. By exploring these three concepts in depth, we can gain a better understanding of the complex relationships between blockchain technology, digital currencies, and market sentiment.

As the cryptocurrency landscape continues to evolve, it will be interesting to see how these trends unfold in the coming months and years.