Rating a free of charge, zero responsibility personal bank loan estimate having pricing as low as nine.90%

There have been two other terminology of this annual interest levels that will be placed on your financial situation, yearly fee cost (APR) and you may annual interest rates (AIR). Appeal is going to be tough to know however with particular general knowledge about how its determined and how its placed on the money you owe, you’ll end up more lucrative from inside the controlling your money. The following is all you need to understand to learn Apr versus Heavens

What is Heavens?

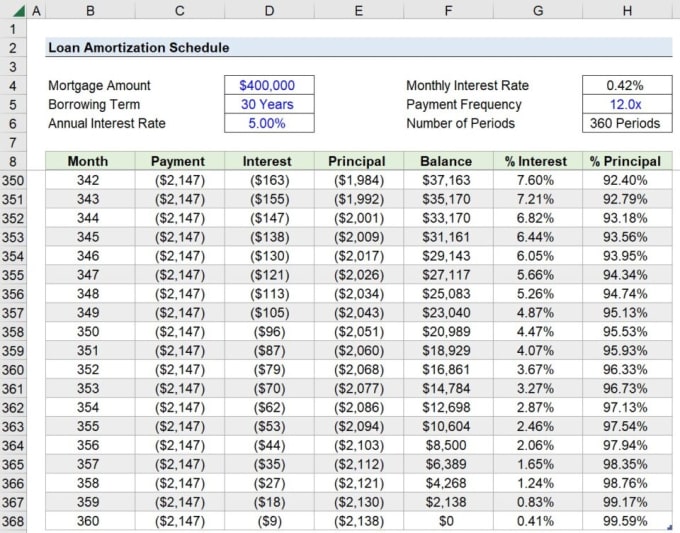

Quick to have Annual Interest rate, Sky is the projected amount of appeal that you will spend yearly in order to acquire a certain number of financing dominating, as if you do come across with an unsecured loan otherwise home loan. The Air are showed since the a predetermined or adjustable payment and lenders tend to typically determine it using this type of equation:

- Complete Attract ? Loan amount ? Amount of Fees Identity

Some lenders use Annual percentage rate (APR) when you compare the cost of more financing affairs, it will not usually write since the accurate from a fact while the Annual Interest (AIR) do, particularly if it comes to payment-centered funds.

Otherwise known as a declining balance loan, installment loans involve a flat sum, and therefore becomes down as soon as you build a repayment. Your financial is always to only charge notice into the balance you to remains. Whether your speed was fixed, it won’t change through your mortgage label and when it’s variable, they varies with Canada’s prime borrowing from the bank pricing.

What’s Apr?

To really understand Sky, you should also know about Annual percentage rate or Apr, which is the yearly interest rate you to lenders cost you to help you use from their website.

- Loan’s occasional rate of interest (rates billed a month)

- Full financing dominant

- Size of your own monthly mortgage payments

- Quantity of months on your own installment title

- Costs and you may interest billed over the lifetime of the borrowed funds

- One savings that is certainly used

You will find several kind of Annual percentage rate one loan providers apply at additional financial products, such as for example playing cards, cash advances and you will personal lines of credit. Annual percentage rate is even put on financing accounts to select the yearly rates an investor produces rather than compounding notice.

How-to Estimate Heavens vs Annual percentage rate

Think about, the new Annual Interest rate (AIR) ‘s the portion of the mortgage principal you to definitely a lender costs you yearly in order to borrow cash from them. Annual percentage rate (ount interesting you need to pay every year, simply they encompasses all the will cost you involved with the loan. Here are a couple out-of earliest advice:

Calculating Heavens

As stated, your own Annual Interest rate are calculated by using the total yearly notice your own bank fees you, separating they by the amount borrowed, following splitting you to number because of the amount of your own cost title. Can you imagine that you have:

- $5,000 of great interest into the an effective $50,000 personal loan, which have a two-year identity

- $5,000 ? ($50,000 ? 2) = 0.05 or 5.00% Heavens

Understand that this is simply a simplified technique for calculating another person’s Yearly Interest. If your bank in reality assigns the Sky, their choice will be based into other factors, such as your income, credit rating and you will financial obligation top. The greater debt health are full, this new shorter chance you really have out-of defaulting on your own mortgage repayments later on. Consequently, the lending company can offer your more substantial mortgage which have a lesser Heavens and you may an extended label.

Figuring Apr

To present a better notion of how Annual percentage rate work, why don’t we use new algorithm revealed a lot more than for the same example (a great $50,000 loan which have $5,000 focus and a two-12 months identity), merely this time we will create a 1% ($550) origination fee to make it much more practical: