Identifying Reversal Patterns for Better Trading Outcomes in Cryptocurrency

The world of cryptocurrency trading is known for its high volatility and unpredictable market fluctuations. As a result, invest One such patern is the reversal indicator, which has been used successfully by many traders to identify potential buy or sell signals.

What are Reversal Patterns?

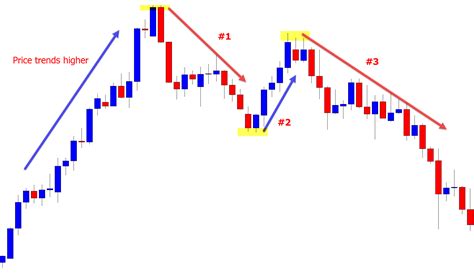

Reversal Patterns Refer to Specific Price Movements or Trading Strategies that indicate a potential change in market direction. These patternns can be identified based on various technical analysis indicators, such as chart patternns, trend lines, and support/resistance levels. By Applying Reversal Patterns, Traders Can Fain Valuable Insights Into Price Movements of Cryptocurrencies Like Bitcoin (BTC), Ethereum (ETH), and others.

Types of Reversal Patterns

There are several Types of Reversal Patterns that can be used in cryptocurrency trading:

- Head and shoulders :

.

- Trend lines

:

- Support and Resistance levels :

Identifying Reversal Patterns

The cryptocurrency market and its underlying trends. Here are some steps to follow:

1.

2.

- Look for confirmation signals : Identify potential buy or sell signals from other traders or market data sources, which can indicate a reversal pattern.

- Test and validate : use and effective.

BENEFITS OF USING REVERSAL PATTERNS

Using Reversal Patterns in Cryptocurrency Trading Offers Several Benefits:

1.

2.

.

Best Practices for Trading With Reversal Patterns

Cryptocurrency Trading, follow these best practices:

1.

2.

- Stay flexible : be prepared to adapt your strategy as market conditions change.

- Monitor and adapt : Continuously monitor the cryptocurrency market and willing to adjust your trading plan accordingly.

Conclusion

Cryptocurrency Trading requires a combination of technical analysis, market knowledge, and risk management skills. By identifying reversal patterns, traders can fain valuable insights into potential price movements and make more informed decisions about their trades.