Elizabeth was a freelance contributor so you can Newsweek’s personal loans cluster, with a look closely at insurance policies. This lady has more than several years of experience coating insurance coverage and you can have composed numerous content getting publications and insurance vendors. Age would depend from inside the New England.

Kristy is a freelance contributor in order to Newsweek’s private financing party. Since an editor, Kristy has worked having web sites including Bankrate, JPMorgan Pursue and NextAdvisor in order to pastime and hone stuff on the banking, handmade cards and you will loans. She is together with composed for publications such as for instance Forbes Coach and you can U.S. Reports and you will Globe. Within her spare time, Kristy likes travelling, hitting-up railway trails and learning.

Lender of America also offers home security personal lines of credit (HELOCs) to $1 million having reasonable charges and some reduced prices for a lower life expectancy Annual percentage rate.

Our very own scientific studies are built to give you a comprehensive information of individual financing items that work best with your position. In order to on the choice-and come up with techniques, our very own expert contributors contrast common choices and you can prospective problems factors, particularly affordability, use of, and you will trustworthiness.

Professional Need

Thanks to Bank off The usa, home owners can also be acquire up to $one million up against the equity in their house and no yearly commission, software fee otherwise closing costs. There are even multiple deals offered, with more discounts to own Bank out-of The usa Common Rewards users. Yet not, Bank out of The united states fees an excellent $450 very early closure percentage, and you also must check out a lender off The united states department to accomplish the newest closing procedure.

- Numerous deals offered

- On line HELOC percentage calculator

- No charge otherwise closing costs into HELOCs doing $1 million

- Have to romantic on a bank regarding The united states economic heart

- Particular gurus are just offered to Lender regarding America Preferred Perks members

- Early closure fee when you pay off the fresh new HELOC during the about three age otherwise reduced

Vault’s Thoughts for the Financial off online payday loans Kremmling The usa

If you are searching to own good HELOC that have reduced charge, all of our Financial out-of The usa home collateral opinion can tell you as to the reasons we believe which providing is a good solution. There is no percentage to try to get a HELOC within Lender regarding America, therefore the lender covers settlement costs towards the credit lines up so you can $1 million. There is also zero yearly percentage with the lifetime of your HELOC.

One of our favourite reasons for having Bank out of The usa is the fact it offers offers which can help you get a very beneficial rate of interest. When you create a primary detachment after beginning an account, you should buy a good 0.10% interest disregard per $ten,000 taken, with a max dismiss of just one.50%. You can save a supplementary 0.25% when you enroll in automated monthly premiums regarding a lender away from The usa checking or bank account.

While you are anyone can be eligible for good BofA domestic guarantee collection of credit, specific gurus are just open to Financial off The united states customers. Particularly, Bank out-of The united states Well-known Rewards players can be be eligible for another dismiss as much as 0.625%.

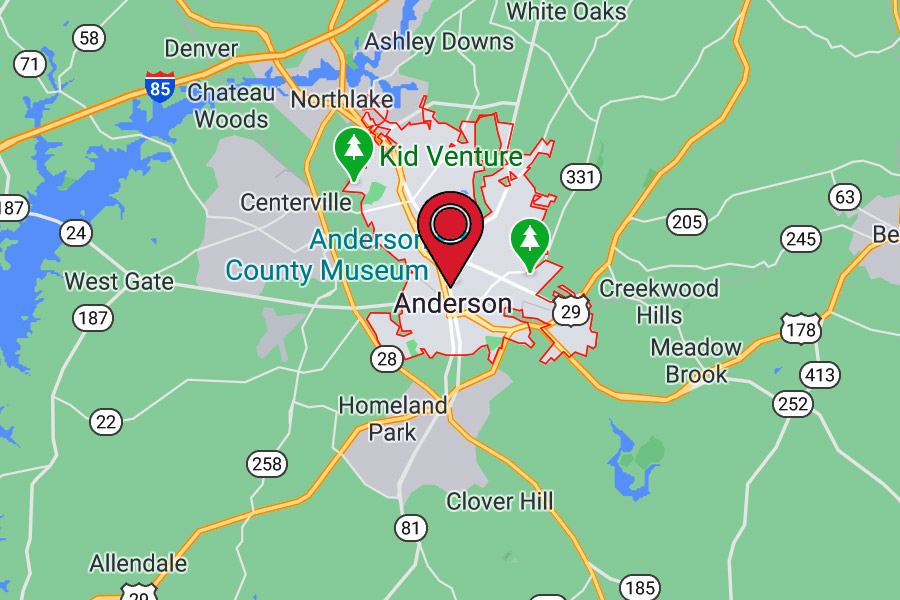

One of many cons from Lender out-of The united states is the fact it costs an early on closing payment to your lines of credit you to definitely meet or exceed $twenty five,000. It may not be the best option for home owners which plan to pay off its HELOC rapidly. And since you will be necessary to intimate at a financial away from The usa part, a few discover an area in your area before you can pertain. Or even alive near a lender out of The usa department, you will want to probably consider an alternate HELOC provider.

On the Financial regarding The usa

Bank out of The united states is amongst the earliest creditors within the the newest You.S. It absolutely was established in 1906 in the San francisco beneath the name Financial out-of Italy. The organization are renamed Bank off The usa within the 1930. Currently, Bank from America is the next-biggest bank in the country, with around $2.4 trillion into the assets and most step 3,700 branch urban centers.