FHA loans bad credit Georgia mortgage conditions and you may assistance generate FHA home mortgages typically the most popular loan system to own basic-time homeowners, consumers which have credit ratings right down to 500 FICO, and you can homeowners with a high-loans in order to money ratios. HUD, new father or mother out-of FHA, ‘s the national department in charge of this new management from FHA funds.

Alex Carlucci, an elder financing manager within Gustan Cho Lovers, covers the brand new putting in a bid combat about Atlanta, Georgia, housing industry:

Just as in other states, Georgia was experience a listing lack of house. You will find bidding battles and you will manufacturers are often choose to be the blend of the best rate and you can strongest homebuyers. Suppliers choose a money offer and are usually careful never to wade over the list rate if the customer will not have the cash in order to create the essential difference between package rates and you may appraised worthy of.

First-big date homeowners with little to no or no borrowing from the bank and you will consumers that have crappy credit minimizing fico scores enjoys a far greater likelihood of delivering an enthusiastic approve/eligible per automated underwriting program for the FHA funds than just traditional loans. Throughout this blog, We will defense new Georgia FHA mortgage criteria in more detail. Gustan Cho Couples doesn’t have financial overlays to the FHA loans crappy borrowing Georgia.

FHA Financing Poor credit Georgia Loan Restrictions To own 2024

HUD, brand new father or mother away from FHA, might have been improving the loan limits towards FHA finance towards early in the day half a dozen years due to increasing home prices. HUD announced the brand new 2024 FHA loan restrict during the $498,257. Even after historical highest financial pricing, out-of-control inflation, all-go out higher home values, and you may an explosive savings, brand new housing market prediction in Georgia was more powerful than actually, states John Strange of Gustan Cho Couples:

The latest housing marketplace inside Georgia was solid. Georgia homebuyers was up against tough race when shopping for home. Putting in a bid battles appear to be new typical. Home values was basically broadening in the a shocking speed. Despite home prices coming to historical highs, house will always be affordable.

Because of skyrocketing home values, the high quality FHA loan limit was $498,257, however it can go up so you can $649,750 inside higher-cost parts in this Georgia. This type of restrictions was adjusted a-year predicated on home price transform. Homeowners inside high-pricing areas on You when you look at the large-rates portion are eligible so you’re able to be eligible for a premier-equilibrium FHA financing.

FHA Financing Poor credit Georgia Institution Assistance Getting 2024

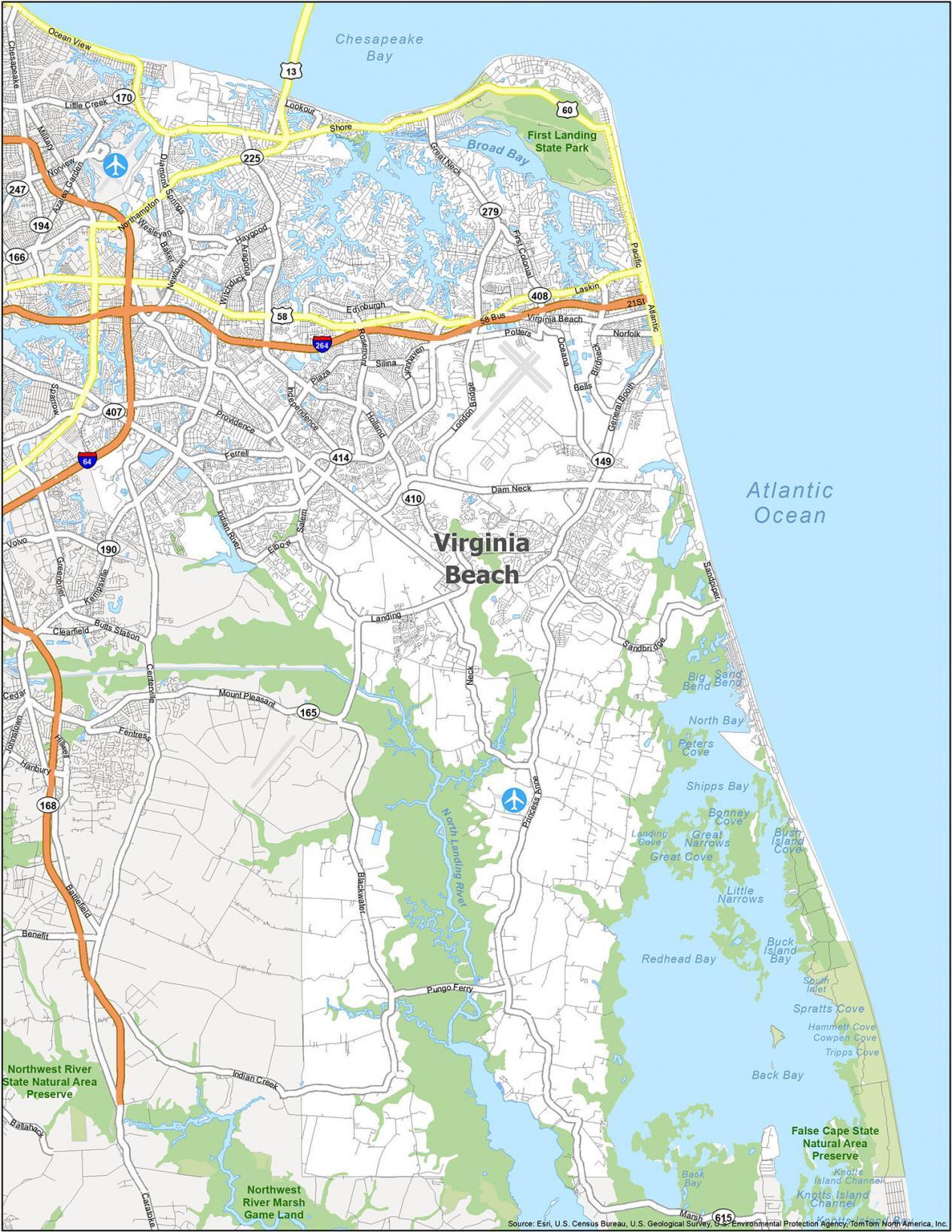

Georgia are a south Condition bordered by the Florida and another out of the country’s fastest-increasing claims. The state is to new eastern of your Atlantic Ocean. It is East away from Sc and To the west of the state out of Alabama. Georgia limits the newest north of the condition out of Tennessee and the state off New york.

Suppose you are looking at to invest in one-home from inside the Georgia. In this case, the latest FHA financing restrictions will let you acquire doing $498,257 in the most common areas. For homes for the highest-costs areas, the loan restriction grows so you can $649,750 payday loan Cheyenne Wells. These numbers are contingent through to conference the desired advance payment and you may credit history conditions. Consult The Mortgage Officer to own FHA Money which have less than perfect credit

Booming Housing marketplace Having Good Need for Home

Its one of several fastest-increasing states for people moving and you may homeowners. Property prices was expanding throughout the entire state off Georgia and no signs and symptoms of a modification. There was a whole lot more demand for construction during the Georgia than there can be list. Many Household Developers put up shop during the Georgia, and you may lenders no overlays have been in request.

Gustan Cho Associates is registered throughout the State off Georgia and you can doesn’t have overlays towards government and you will antique funds into the Georgia. This article will defense and you will discuss FHA money less than perfect credit Georgia.