“The Ever-Changing Cryptocurrency Prices: Understanding Price Action, Digital Wallets, and Peer-to-Peer Trading”

In recent years, cryptocurrency has become a growing market with its own set of unique trading strategies. As a digital currency that operates independently of traditional financial systems, it’s no surprise that investors are drawn to the potential for high returns. However, navigating this complex and fast-moving market requires a thorough understanding of price action, digital wallets, and peer-to-peer trading.

What is Crypto Prices in Flux?

Cryptocurrency prices can fluctuate rapidly due to market sentiment, news, and other external factors. This means investors must remain vigilant and adapt their strategies to changing conditions. Price action refers to the daily movements of cryptocurrencies, including trends, reversals, and periods of consolidation.

Understanding Digital Wallets

Digital wallets are software programs or services that allow users to store, send, and receive cryptocurrencies on a peer-to-peer basis. Some popular digital wallet options include Coinbase, MetaMask, and Trust Wallet. These wallets offer individuals a secure way to buy, sell, and store cryptocurrencies without relying on centralized exchanges.

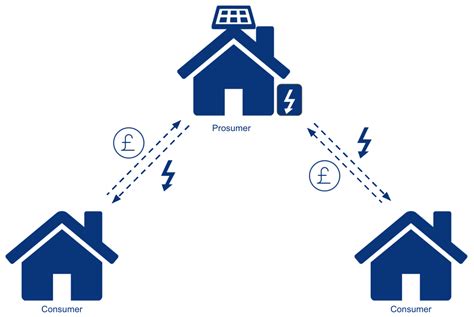

Peer-to-Peer Trading

Peer-to-peer trading refers to the buying and selling of cryptocurrencies between individual investors, rather than through traditional brokers or exchanges. This model allows for greater flexibility and control, as investors can set their own prices and trade at any time. However, it also carries higher risks, including the potential for significant losses if market conditions change quickly.

Key Concepts to Understand

When trading cryptocurrencies, investors should understand several key concepts:

- Support and Resistance: These are areas of high price activity where buyers or sellers tend to congregate.

- Trends: Long-term trends can indicate the overall direction of the market, while short-term trends can be more volatile.

- Rallies and Breakouts: These are periods of rapid price growth or decline that can be important catalysts for market movements.

Best Practices

To be successful in cryptocurrency trading, it is essential to follow best practices:

- Stay Informed: Stay up-to-date with news, analysis, and market trends.

- Use Multiple Exchanges: Diversifying your portfolio across multiple exchanges can help mitigate risk.

- Set Clear Goals

: Determine your investment strategy and risk tolerance before entering the market.

Conclusion

The ever-changing prices of cryptocurrencies require a thorough understanding of price action, digital wallets, and peer-to-peer trading. By understanding these fundamental concepts and following best practices, investors can increase their chances of success in this rapidly evolving market. Whether you are a seasoned investor or new to cryptocurrency trading, it is essential to stay informed, adapt to changing conditions, and always err on the side of caution when investing in cryptocurrencies.