There are numerous things to consider while seeking to home financing. The first thing to manage is to try to determine new course your desires to sample repay the borrowed funds, usually anywhere between ten and you will 30 years. Longer menstruation cause higher total focus however, shorter monthly payments.

Next, there are two categories of interest rates: variable, that’s susceptible to are different over the years, and you may fixed, and therefore remains constant. You should upcoming go with the sort of mortgage. Antique financing is actually available everywhere and have the possibility of an effective modest down payment; not, PMI may be required in the event your deposit was less than twenty %.

Funds supported by government entities, including USDA, Virtual assistant, and you can FHA financing, render many selections. By way of example, you do not need certainly to establish any cash to own Virtual assistant otherwise USDA loans, and receiving an FHA mortgage could be convenient if for example the credit get is gloomier. Simultaneously, you might want a good jumbo mortgage if you find yourself to get an incredibly pricey family.

When looking for a home loan, its important to look around and you can measure the now offers regarding numerous creditors. To find the best offer, evaluate rates supplied by borrowing unions, financial institutions, an internet-based financial institutions. Acquiring quotations of three or maybe more team is actually brilliant to make sure that you may also examine them.

There are lots of points you need to know when comparing. Firstly, check the number and you may interest rate of mortgage youre taking right out; this is exactly high because set your own monthly payment number. Additionally, while the count necessary for this new advance payment varies centered on the mortgage vendor, you must determine extent you need.

It would be of good use for folks who felt every other expenses relevant on mortgage, particularly items or mortgage insurance rates. These expenses is mount up, so be sure to imagine all of them and work out the decision. When you compare creditors, select other charges and closing costs.

Receive a good Pre-Acceptance Loan

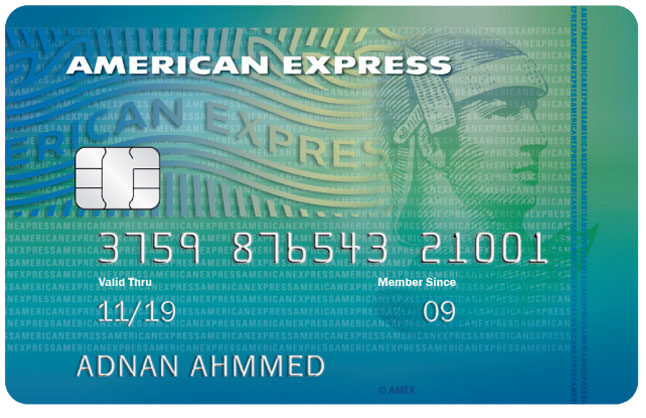

Before buying a house, obtaining pre-recognition for a financial loan of several providers is vital. Understanding the level of fund you could acquire tends to make it convenient. A number of files must be published to discover pre-approval. Very first, you need per borrower’s personal defense wide variety and you may photographs IDs. Second, you’ll have to present paychecks in the earlier day because proof of income.

You must have this new income tax variations towards early in the day a couple years showing debt stability. You will then be needed to introduce the lending company comments to own for each and every be the cause of the past a couple months. You ought to along with collect a list of all your valuable debts, in addition to fund and you may charge card balance. We are going to also require track of a career together with get in touch with pointers to suit your expose boss.

And, remember to reveal all of the associated advice concerning initial financing, including your resource source. It’s important to keep in mind that receiving pre-acceptance will not make sure approval on loan. After you register for a particular loan for the property your want to purchase, the final approval happen after. Loan providers tend to examine your funds way more directly during this method to make certain things are managed.

Conclusion

When purchasing a house, selecting the right lender is extremely important. To find the greatest creditor to you, you have to do your homework and you will glance at a number of options. Be certain that the grade of the borrowing and determine extent your can also be spend. Know about the many choices for financial support and get pre-recognition off some providers. Later on, you might with full confidence seek out your ideal assets and choose your chosen provider.

Brand new upfront financial cost (UFMIP) have to be paid down in the closing, given that annual financial insurance fees americash loans Hollywood (MIPs) try due on a yearly basis throughout the life of the loan. The amount of these money are very different based activities such because the credit history, loan-to-value proportion, and you may loan label duration.

One of the standout features of a keen FHA loan was its reduce payment requirement, usually as low as step three.5%. While doing so, the financing standards be much more easy as compared to traditional fund. Because of this, those with a reduced credit score will discover it simpler to be eligible for home financing lower than this method.

She and asserted that I ought to rating a buyer’s representative, maybe not an excellent seller’s representative (basically consider their own text), as good seller’s broker will simply have the seller’s desires at heart, basically. An effective seller’s agent will attempt to discover the large rate for the seller, whereas a customer’s broker will endeavour and you can force the purchase price off as little as possible for the consumer.

But focusing on how the fresh public auction works will empower you to definitely create a quote in the event the date excellent. On top of that, attending during the-person deals and you will learning how they work is a great method so you’re able to get acquainted with the procedure.

Determine what you need to buy a public auction property so you can succeed well worth it, both due to the fact a citizen or a trader. It could be hard to adhere, especially in the outcome from a putting in a bid combat, whenever attitude run large. But when you know precisely when you should disappear, you will avoid overpaying to possess a market possessions.

The brand new Government Houses Expert (FHA) finance is mortgages that allow consumers with less resource and you will credit being home owners. FHA money are often used to pick nearly any domestic, even though the possessions have to satisfy specific worthy of and security conditions. Such statutes are meant to manage consumers away from attributes that are not to code and come in handy when selecting property foreclosure. The method usually usually include a fee appraisal, that’s thought of as an appraisal and you will house evaluation in one. ( you is have an additional domestic evaluation over on the house or property.)