“Cryptocurrency Master: Full Buy, Technical Evaluation and Commercial Guide”

The world of cryptocurrencies has grown exponentially in recent years, attracting millions of investors around the world. With the increase of digital currencies, such as Bitcoin, Ethereum and others, the landscape becomes more and more complex. It is very important to understand markets, technical and trading evaluation indicators in this space.

What is cryptocurrency?

Cryptocurrencies are decentralized digital assets that use cryptography for safe financial operations. Unlike traditional currencies, cryptocurrencies work independently of central banks and governments. The most popular cryptocurrency is Bitcoin (BTC), which in 2009 began an individual or group using the pseudonym Satoshi Nakamoto.

Purchase of cryptocurrency: step by step

Before investing in cryptocurrency, we need to understand how to buy it safely and efficiently. Here are a few steps to follow:

- Select a reliable exchange : Look for a trading platform that offers high liquidity, low taxes and reliable security measures. Some popular exchanges are co -Binance and Kraken.

2.

- Deposit Funds : Add a payment method to your account, such as a bank transfer or credit card to buy cryptocurrency.

- Select the currency : Choose cryptocurrency you want to buy, taking into account the capitalization of the market, the volume of trade and the percentage of adoption.

- Send an order

: Use the Exchange user interface to send the purchased order of cryptocurrency, specifying the amount and price.

Technical evaluation: understanding of cryptocurrency prices

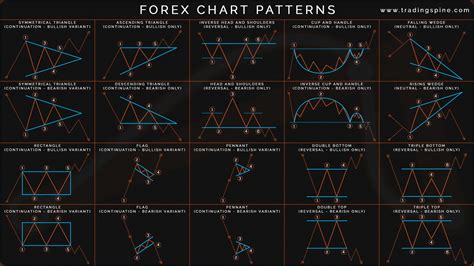

Technical evaluation is an essential aspect of investments in cryptocurrency. This includes the analysis of historical data, trends and models to predict future price changes. Here are some of the basic technical indicators to be considered:

1

- RSI (Relative resistance index) : Measure the amount of price changes to evaluate the conditions to be resolved or overcrowd, indicating the ability to buy or sell options.

- MACD (differences in average convergence) : Set possible fractures by analyzing the difference between two movable environments and drawing it according to the CCI (channel index).

- Bands Bollinger : Prices to evaluate the volatility and identification of possible purchase or sale signals related to price shares and market conditions.

Commercial indicators: Successful Trade Key

Commercial indicators are used to analyze market data and make reasonable investment decisions. Here are some popular trading indicators:

1

2.

3.

- Crossing Medium : Set possible purchase or sales signals, analyzing two mobile media.

The best trading practice of the successful cryptocurrency

To be successful on the cryptocurrency market, follow these good practices:

1

2.

3.