It’s required to render particular and complete paperwork, take care of unlock interaction together with your loan administrator, and you may respond on time to the wants considerably more details.

Activities Thought Through the Underwriting

For the loan underwriting techniques, lenders meticulously glance at numerous points to assess the exposure with the giving a loan. Wisdom such activities will help consumers ready yourself and boost their opportunity from a successful underwriting benefit. Here are the key factors thought inside the underwriting processes:

Credit history and Get

Among the first activities lenders think ‘s the borrower’s borrowing from the bank background and you will credit rating. The credit record brings understanding of the individuals earlier borrowing choices, as well as the payment record, a good expenses, and you can people early in the day delinquencies otherwise bankruptcies. The financing rating, typically ranging from 300 so you can 850, summarizes the borrower’s creditworthiness centered on their credit score. Increased credit history suggests straight down credit risk.

Lenders fool around with credit history and you can rating to assess the fresh borrower’s ability to cope with loans sensibly. A powerful credit score and you may a leading credit history increases the likelihood of financing recognition and may also cause much more advantageous financing terms and conditions.

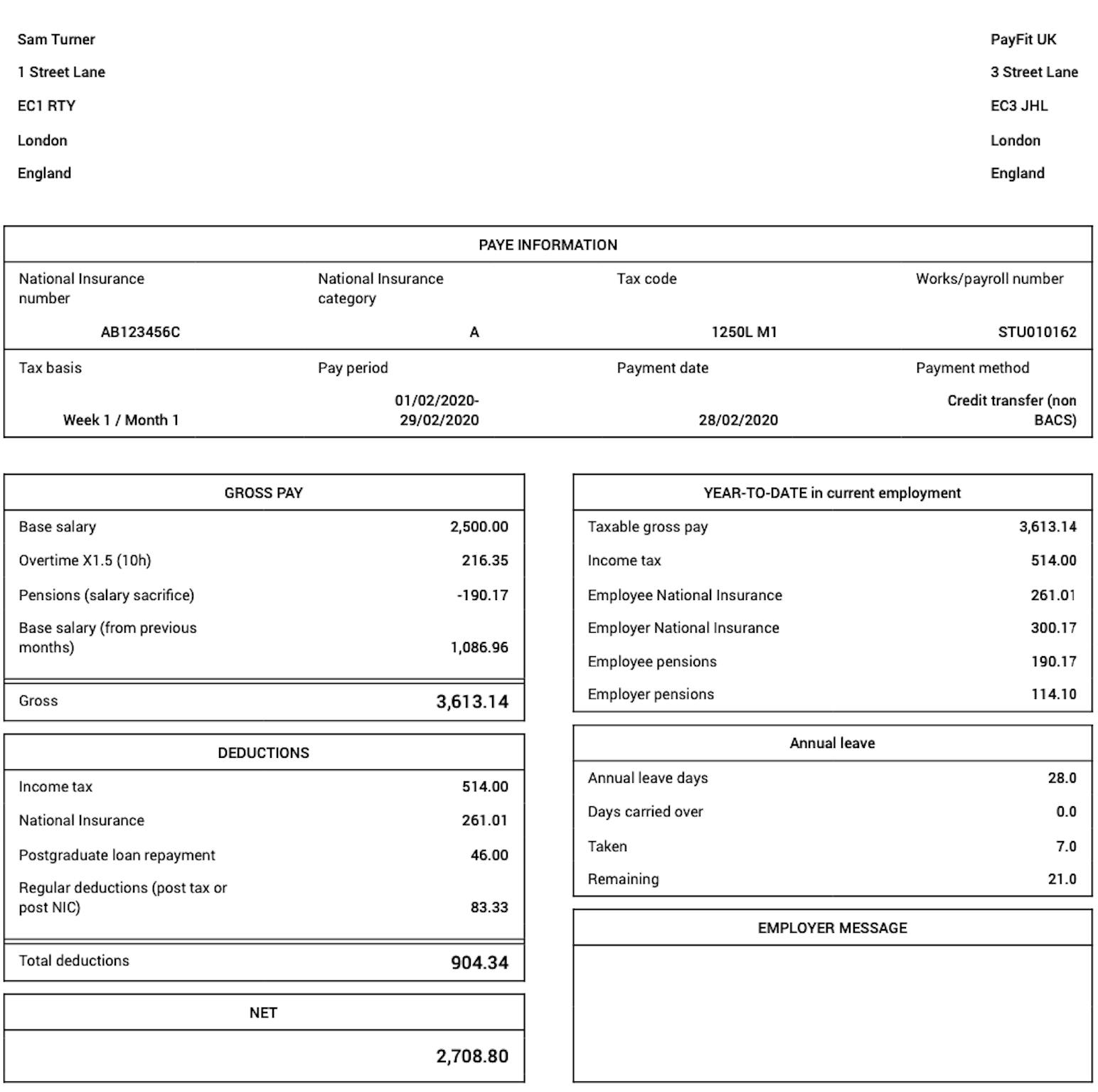

Earnings and you can A career Verification

Loan providers in addition to gauge the borrower’s income and you can a career balances to make certain their ability to repay the loan. Confirmation of money comes to reviewing shell out stubs, tax statements, and bank comments to verify new borrower’s money present and their surface. Secure a career background demonstrates the borrower’s ability to create a typical money, that is essential for appointment mortgage personal debt.

Lenders generally speaking assess the fresh borrower’s obligations-to-earnings (DTI) ratio to assess its financial capability. The latest DTI ratio measures up the latest borrower’s monthly financial obligation payments on their disgusting monthly income. A reduced DTI proportion implies a healthier budget and you will develops the possibilities of mortgage acceptance.

Debt-to-Income Proportion

The debt-to-earnings (DTI) proportion try a life threatening cause for this new underwriting procedure. They stands for the fresh new portion of the new borrower’s monthly gross income one to goes toward debt money, in addition to housing expenditures, credit debt, student loans, and other outstanding loans. payday loans Coleytown A lower life expectancy DTI proportion implies a lowered amount of debt obligations and you will a higher ability to undertake most financial obligation.

Lenders routinely have certain DTI requirements for loan acceptance. Once the accurate tolerance may vary according to the mortgage sorts of and lender, a lower DTI proportion are noticed significantly more good. What is very important to own borrowers to manage their obligations and prevent using up too much financial obligations before applying for a financial loan.

Loan-to-Worth Proportion

The loan-to-worthy of (LTV) ratio is another foundation felt throughout underwriting, particularly for mortgage loans. New LTV ratio compares the borrowed funds total the newest appraised worth of the house being funded. It can help loan providers measure the chance in the financing because of the deciding the newest borrower’s collateral on possessions.

A lowered LTV proportion ways an inferior loan amount in line with the house value, and therefore reduces the lender’s exposure. Loan providers typically have maximum LTV conditions, specifically for mortgage loans, to safeguard the capital if there is standard. Consumers having a high advance payment or more collateral in the possessions generally have a diminished LTV ratio, expanding their possibility of mortgage approval.

Insights these circumstances as well as their advantages regarding the underwriting process can also be help individuals ready yourself the economic character and increase its chances of a successful loan application. By the keeping a confident credit rating, secure income, in check loans, and you can an effective LTV ratio, consumers is also status by themselves definitely into the underwriting techniques.

Popular Effects of Underwriting

Because the financing underwriting techniques is complete, there are a few it is possible to effects you to individuals could possibly get find. These outcomes see whether the borrowed funds software is accepted, conditionally approved, or declined. Why don’t we look closer at every of those outcomes.