Unlocking of RSI power: a beginner guide to the use of this powerful indicator in cryptocurrency trading

In the frenetic world of cryptocurrency trading, making informed decisions is crucial to achieve success. An indicator that can help traders make better choices is the relative resistance index (RSI). In this article, we will deepen how to use RSI in your trading strategies and explore its benefits and limitations.

What is RSI?

The relative resistance index (RSI) is a technical analysis tool developed by J. Welles Wilder Jr. which measures the extent of the recent variations in prices to determine the conditions of sovereign or superimposed on the market. It is calculated as the ratio between the difference between the closing price and the average price, divided by the standard deviation of prices.

How RSI works

The RSI formula is:

RSI = 100 – (100 / (1 + RS))

Where:

– RS (relative resistance) is the ratio between the highest point and the low point of a price range in a certain period.

– The average value is calculated with an average of the highest and lower values for an set period.

How to use RSI in your trading strategies

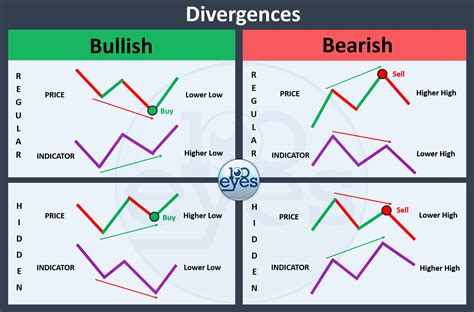

- Determine your trading style : if you are a trendy follower, look for divergences between prices and RSI levels. If you are a flow trader, focus on the upper and lower limits of the price action.

- Identifying the conditions of sovereign and hyper -time : when RSI is over 70 years old, it can be a condition of hyper -compliance, while below 30 it indicates a hyper -fought condition.

3

- Set the arrest and take-profit levels

: regulates the stopping and socket levels based on the RSI level, especially when negotiating in volatile markets.

When to use RSI

- Signs of registration : Use RSI as a signal of registration for new operations, in particular when you are looking for a clear revision of the trend.

- Risk management : Use RSI to set the stop levels and manage the risk by limiting the losses when the indicator is hyper -fought or assumed.

3

RSI limitations

- Sensitivity to price movements : RSI is sensitive to price movements, so it is essential to understand its limits and regulate your strategy accordingly.

2

- Excessive emphasis on technical indicators : RSI must not be invoked as the only basis for trading decisions; Other factors such as fundamental analysis and risk management are also crucial.

Conclusion

The relative resistance index (RSI) can be a powerful tool in your cryptocurrency arsenal if used correctly. By understanding how to apply RSI in combination with other indicators, you will be able to make more informed trading decisions and avoid false signals. Remember to always manage the risk and combine technical analysis with the fundamental analysis for an all -round trading strategy.

Tips and resources

* Trading practice: before using RSI in real -time trading, practice on a demo account or on the paper trading platform.

* Learn from experts : Study the work of successful traders who use RSI in their strategies.

* Resources:

+ The website of the relative resistance index (RSI)

+ YouTube tutorials and videos

By incorporating RSI into your cryptocurrency trading strategy, you will be better equipped to navigate in rapidly evolving markets and achieve success. Happy trading!