As the behavioral economy forms encryption technology investment strategies

The cryptocurrency market was known for its unpredictability and volatility, making it a complex space for investment. However, when developing a market, they understand how the behavioral economy is investing strategies necessary for success. In this article, we deepen ways to how psychological bias influence investors’ behavior and decision making, and investigate how these insights can be used to form effective encryption currency investment strategies.

Investment Psychology

Behavioral economists have identified several key psychological factors that influence investment decisions. That is:

- Confirmation Exception : The tendency to look for information confirming current beliefs or opinions.

- Increase Effect : The tendency to rely too much to the first detected information, even if it is incorrect.

- loss aviation : fear of loss more than possible profits.

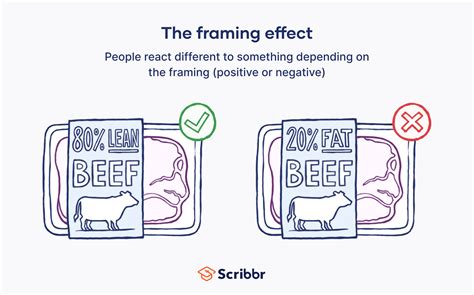

- Framework effect : Providing information can affect investment decisions.

These psychological bias are often found in the cryptocurrency market, where investors can be influenced by emotions such as tension or fear when they face new information. For example, a sudden increase in price can encourage some investors to “buy a fall” in the hope of getting a low point before returning prices.

Investment strategies based on behavioral economy

In order to determine this bias and make a more conscious decision on investing, it is necessary to consider how the behavioral economy constitutes the behavior of the cryptocurrency market:

- By spreading investment over time, this approach can reduce the impact of emotions and help maintain a long perspective.

- By setting an order for suspension loss, investors may avoid impulsive solutions based on the latest price fluctuations.

- Diversification : The distribution of investment between different assets can reduce the impact of all specific encryption or market trends.

- Risk Management : Investors should regularly assess and adjust the risk level in response to market conditions or in their personal financial situation.

Case Analysis: How the behavioral economy has influenced the solutions to investing

There were many examples of how the behavioral economy has influenced investors’ decisions in the cryptocurrency market. For example:

- 2017 Market volatility : 2017 During the Bullfight, some investors have become too optimistic, believing that the price will continue to increase so far. As a result, the demand for cryptocurrencies such as Bitcoin and Ethereum has increased, causing the expected price.

- 2018 FUD campaign : The cryptocurrency market has suffered many times of fear -based sales, when rumors and incorrect information have spread about possible adjustment changes or other topics affecting individual encryption castles.

In contrast, investors who followed more investment strategies such as Dollar Point and Stop loss orders could not better control their risk and navigate these periods of variability.

Conclusion

The behavioral economy plays an important role in developing encryption strategies. Understanding how psychological bias affects the behavior of investors, we can create more effective investment methods that help us navigate the marketplace. Whether you are an experienced investor or just starting, the involvement of the behavioral economy to portfoliosis can change.

Recommendations for investors

1