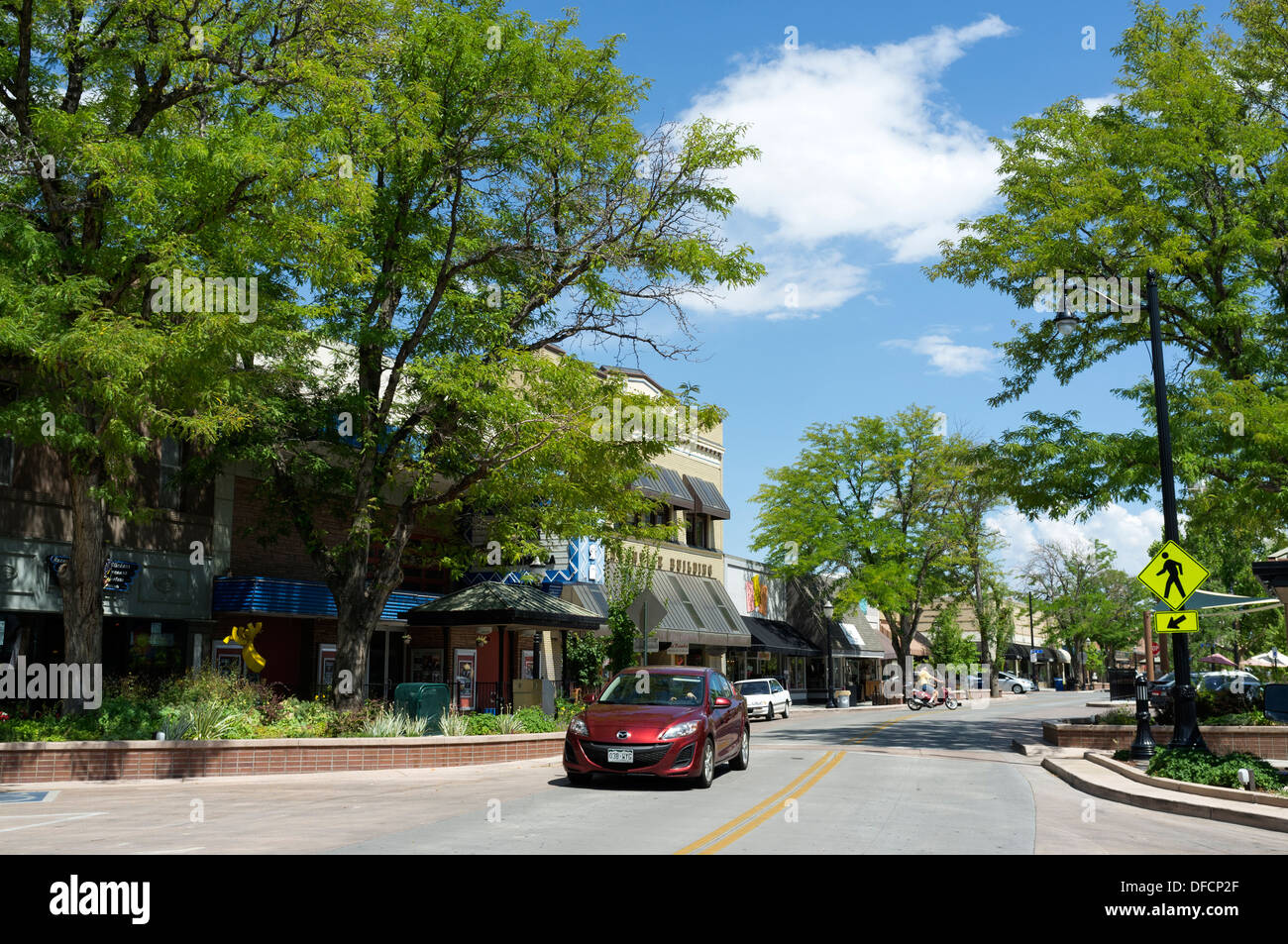

As Colorado homeowners browse a challenging sector which have restricted list, some are looking at link loans so you can express the whole process of to order a different home and you may attempting to sell its old one

- Independency during the timelines: Need not connect upwards selling and buy dates perfectly. This program will give you respiration place so you’re able to package their circulate rather than impression hurried.

Just like the Texas homebuyers browse a difficult industry which have minimal collection, most are looking at connection loans to explain the procedure of purchasing a new domestic and you can selling the old that

- Financial assurance: Leave behind the stress regarding prospective double mortgage loans or dipping on the coupons so you’re able to link the brand new pit between residential property.

Since Tx homebuyers navigate a difficult industry with restricted directory, some are looking at bridge finance to help you express the entire process of to acquire a different sort of domestic and you will offering the old you to definitely

- Enhanced to shop for strength: During the a seller’s markets, a low-contingent give can also be stand out, increasing your probability of getting your ideal home.

Given that Colorado homebuyers navigate a difficult field with limited collection, most are embracing connection money to clarify the entire process of to acquire a special house and you will promoting their dated you to

- Sell for as much as 10% more: Once you flow, you might checklist the old household unoccupied and you can possibly staged, which loans Silverthorne CO can lead to a top price point, predicated on HomeLight deal research.

Getting property owners trapped regarding the buy-offer conundrum, HomeLight’s Purchase One which just Offer program offers a handy and you can fret-reducing service. Look for a lot more program info at that hook up.

HomeLight also offers almost every other attributes to own homebuyers and you may vendors in the Tx, such as for example Broker Match to obtain the top-doing real estate agents in your industry, and easy Product sales, a convenient means to fix discover a no-obligations, all-cash promote to sell your property within ten months.

Link fund assist residents borrow secured on the fresh guarantee they have built within earlier the place to find put on their brand new pick, going for more hours to sell and you may taking away the majority of the effort of getting this new timing perfectly.

HomeLight Lenders NMLS #1529229 | Equivalent Construction Bank | | homelighthomeloans/licenses-and-disclosures | 1375 Letter. Scottsdale Rd., #110, Scottsdale, AZ 85257 Mobile 844-882-3283

From the HomeLight, all of our eyes is a scene where every home purchase are easy, specific, and you can rewarding. Ergo, we promote strict article ethics for the each of our listings.

One lender will get determine your debt-to-income ratio (DTI) in order to be considered you to own a bridge loan. Which DTI could include your current mortgage repayment, the loan payment with the new home if it’s not around package which have a buyer, therefore the appeal-simply fee toward bridge loan.

Even more mortgage can cost you

Domestic guarantee mortgage: A property guarantee loan lets the latest borrower to utilize the existing collateral in their most recent family given that guarantee. These types of mortgage brings an effective lien up against the assets and reduces the security the new resident possess in the home. Interest rates is generally greater than the speed towards the basic financial. A plus, not, is the fact instead of going for a cash-out refinance towards, particularly, a great $three hundred,000 financial with an interest rates away from step three% off $eight hundred,000 from the 5% to repay the original mortgage and borrow $100,000 cash, you can just obtain $100,000 in the six%, making the initial mortgage in place from the the down price.

Due to the fact Tx homeowners browse a difficult sector having limited index, most are looking at bridge funds in order to express the whole process of to buy another home and you will promoting their dated one

- Offer your house or apartment with assurance: Once you transfer to your new home, we will record your unoccupied home on the market to draw the strongest offer you can. You’re getting the rest of your collateral following the household deal.