For people who very own your residence, you will be accountable for maintaining the condition, and may lay a-strain on your handbag. For this reason really it is strongly suggested remaining step 1% of one’s house’s worthy of or $step one for each sq ft during the a family savings to help defense solutions. Home insurance just discusses specific potential risks, so if you split their sink or your homes roof must getting changed due to years, you might be with the hook up for the prices. And you can home solutions will likely be expensive. In 2020, an average loved ones spent $step 3,192 on household restoration will cost you and you may $1,640 to possess crisis programs, predicated on HomeAdvisor.

You happen to be capable security slight repairs out of your crisis discounts, but what if you want to change your heater or repair their basis (which can each costs thousands personal loans for bad credit Arkansas of dollars)? If you are not sure how to pay money for a necessary family fix, borrowing from the bank money was a choice.

What exactly are family fix financing?

When you need help funding an expensive treatment for your home, you may use a home resolve financing, that is an umbrella name for your kind of loan utilized to pay for house solutions. Every type regarding family repair mortgage has its very own advantages and drawbacks, and some are easier to qualify for than others. The choice that is most effective for you will rely on individual affairs, such as your credit history in addition to matter you ought to obtain.

Personal loans

With regards to the financial, you can borrow anywhere from $1,100 to help you $fifty,100000 or maybe more, and since the cash are used for whichever objective, you should have independence which have the method that you purchase it. This is exactly beneficial if you would like combine certain obligations at the same time you have to pay for your home resolve, such as for instance. Additional big benefit of unsecured loans is the fact that the funds try approved easily, usually within an issue of months.

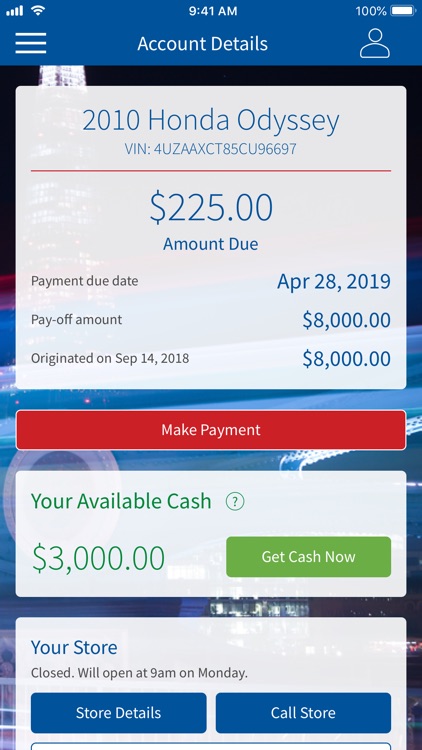

Really personal loans was unsecured, meaning they won’t wanted security, but it is you can to get a personal loan secured by your automobile. Talking about referred to as vehicles equity financing and often include straight down rates than simply unsecured signature loans, especially if you provides reasonable borrowing from the bank. Like with very finance, the lowest cost is kepted for the most creditworthy consumers, but it is plus it is possible to to obtain a zero-credit-consider consumer loan, referred to as a repayment loan. This type of include greater cost, however, on one helps you build credit therefore you have better credit solutions subsequently.

Most lenders has a great prequalification procedure that enables you to check your own price in place of damaging your own borrowing from the bank, so you can contrast selection out-of additional lenders. Be sure to take note of the origination fee, and that’s taken out of the cash you can get, as well as the Annual percentage rate, and therefore signifies the full cost of borrowing from the bank. When you can, avoid personal loans which have prepayment punishment.

Family guarantee finance

Property collateral financing try an approach to tap the equity you may have of your house. Generally, you happen to be credit back a portion (usually as much as 85%) out-of what you already paid in via your mortgage repayments. As with a personal bank loan, you’ll get a lump sum which have fixed interest levels, and you will terms and conditions typically history four to fifteen years. When you’re by using the currency to make a significant upgrade, particularly replacement your own Heating and cooling program, rather than a typical fix, the eye can be taxation-allowable.

The newest drawback is the fact possible spend settlement costs as you did along with your financial, and these is also run-up so you can 5% of your prominent. Their interest rate also most likely getting more than their first mortgage. And since a home equity loan was safeguarded by the house, for those who be not able to take care of the mortgage money, your chance property foreclosure.