- Has actually Analysis

- To invest in a house

- Refinancing

- First-Time Homebuying

- The trail so you can Homeownership

If you’re looking order your first domestic, you can even feel overloaded and you may being unsure of of the place to start. And here i come in! Which have NASA Federal, tens and thousands of participants keeps understood the think of purchasing the first house.

Smart, Individual Services

All of our loyal people away from Home loan Pros can walk you through most of the action of the homebuying techniques. We’ll ensure it is as easy as possible and provide you with individualized investment selection that suit your financial budget.

Their borrowing from the bank takes on an important part from the https://paydayloancolorado.net/rangely loan acceptance procedure. As much as possible improve your credit, you could eventually improve terms of our home mortgage, which can save a little money in the end.

Before going household shopping, it is good to recognize how much family you really can afford stand inside your safe place. This will help to you then become a informed consumer ahead of dropping within the like with a property that force their limitations financially.

Understand that even although you are presently leasing, houses will cost you can include fees, Private Financial Insurance policies (PMI), utilities and other affairs may also increase your month-to-month housing pricing.

What about a deposit? Lenders bring a variety of mortgages to complement buyers’ unique circumstances. This consists of NASA Federal’s $0 off, zero PMI home loan. step 1

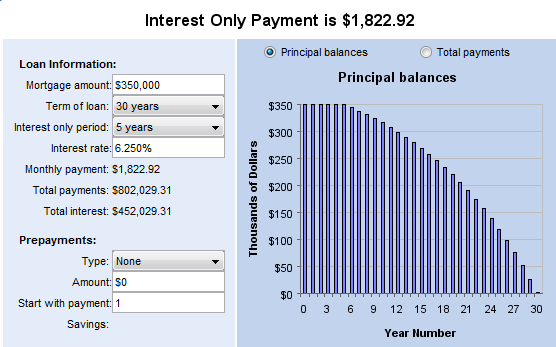

Please note: the fresh new computed monthly payment is actually for prominent and you will attract (P&I) just. Any fees, homeowners’ insurance and home loan insurance rates (PMI), in the event the relevant, would be put into brand new P&I and also make an entire payment per month.

Once you know the amount of money you could invest in a great family, you’ll be able to to determine where you can manage to call home.

- Here are a few median income, cost-of-living, and you will home conversion process analytics.

- Determine what assets taxes will be, or the top-notch the college program when you look at the for each and every town if the you’ve got students.

- After that, make a list of the top areas you could potentially manage, realizing it may need to changes and you can build centered on just what is actually available during the time.

Do you want an individual-home? Otherwise carry out a beneficial townhome otherwise condominium work as well? Determining these details basic, and it’s really sensible in the maybe not receiving everything into their should record, can not only help save you date however, potential disappointment also.

To simply help help you with selecting and you may financial support your perfect house, you want some things: an established agent including a dependable monetary spouse simply to walk you from financing processes both of that you make it through NASA Government.

Select a realtor and you may homes close by with all of our HomeAdvantage System. Simply enter in your zip code to get going.

That with a participating real estate agent, you might be eligible to discover a rebate to-be applied towards the closing costs and possess usage of the Multiple listing service (MLS). You might modify the household have you are interested in and you can discovered notification whenever one attacks the market industry.

Good NASA Federal Mortgage loan Manager will help having a mortgage, that gives professional advice every step of your method.

Trying to find addiitional information?

Only submit this form plus one of our own Home loan Professionals usually reach out to you to answr fully your issues – no obligation no connection called for.

Happy to begin the homebuying excursion?

step 1 Membership and you may eligibility required. Unique loan software available to really-qualified candidates. Specific limits will get pertain. Even offers good getting pris is actually short-time even offers and can prevent when instead of improve see. Zero Down Applications for new primary house requests or doing 95% towards refinances regarding the pursuing the appointed components just: CO, CT, DC, De-, Florida, GA, MA, MD, Me personally, MN, NC, NH, Otherwise, PA, RI, Tx (the newest commands just), Virtual assistant, VT, WA & WV. Almost every other home loan software offered nationwide (but AK, Hello, and Nj). Consult with a great NASA Government First-mortgage Loan Expert to possess mortgage details and you may costs.

Fee Analogy: An effective $250,000 30-season repaired price having zero circumstances and you can mortgage of seven.000% (7.148% APR) would have a monthly dominating and you may attention fee equal to $step 1,. New payment revealed doesn’t come with PMI, taxation, insurance rates or other applicable escrows. The true fee obligation could well be higher whenever talking about used.